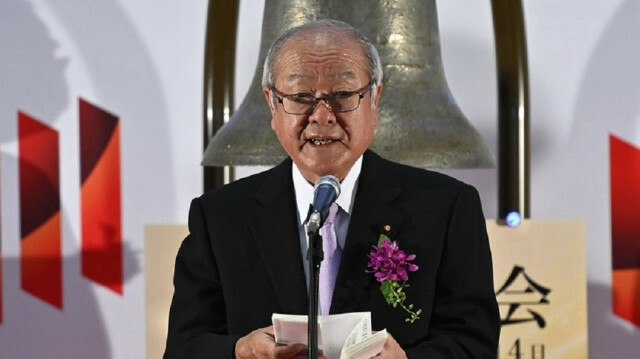

Japan facing 'fiscal situation that is increasing in severity at an unprecedented level,' warns Shunichi Suzuki

Japan’s fiscal health has been worsening with “unprecedented” severity after the surge in government spending in response to the COVID-19 pandemic and Ukraine war, Finance Minister Shunichi Suzuki warned on Monday.

Suzuki said it is vital to secure fiscal space for Japan in case of future crises, according to local media outlet Kyodo News.

“Public finance is the foundation of national trust. It is essential that we ensure we have the fiscal space to prevent Japan’s credibility and the livelihoods of its people from being undermined in times of emergency,” he told the country’s parliament.

Economic conditions are becoming “increasingly severe” due to surging prices and mounting fears of a global economic slowdown caused by monetary tightening, he warned.

“After taking steps to cope with the novel coronavirus pandemic and drawing up supplementary budgets, we face a fiscal situation that is increasing in severity at an unprecedented level,” he added.

The government will aim for economic revitalization before fiscal reconstruction, according to the minister.

Suzuki urged lawmakers to quickly approve a proposed budget of 114.38 trillion yen ($885.3 billion) for fiscal year 2023.

The draft budget includes funds to help households hit by inflation, besides plans for record defense spending as Japan aims to enhance its capabilities amid security threats, according to the Kyodo report.

“At this turning point in history, the fiscal 2023 budget will chart a path toward solving the critical challenges we face at home and abroad, helping us carve out our future,” Suzuki said.

The COVID-19 pandemic and spiraling inflation have led to calls for more government spending, further threatening Japan’s fiscal health, “already the worst among major developed nations,” read the report.

Japan’s annual inflation was at 4% in December, higher than the central bank’s target of 2% for the ninth straight month.

Last week, the Bank of Japan decided to maintain its ultra-low interest rates and yield curve control targets.

The bank kept its key short-term interest rate unchanged at minus 0.1% and 10-year bond yields at around 0%. Surprisingly, it also made no change to the new 0.5% cap for the 10-year government bond yield.